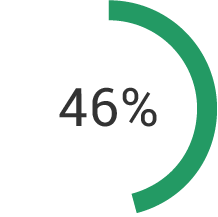

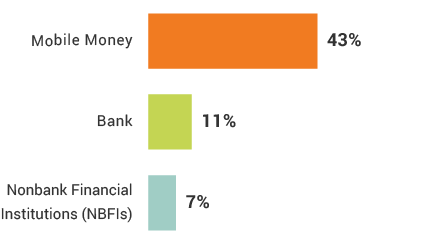

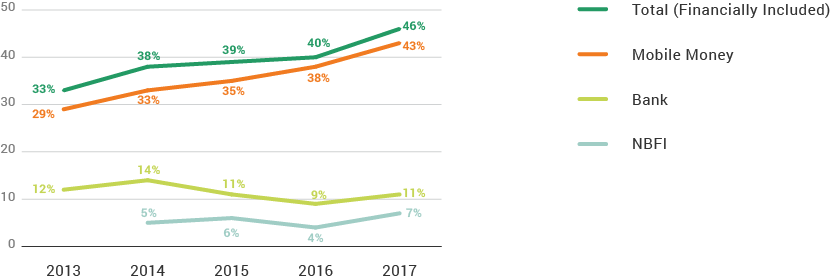

An increasing number of Ugandan farmers are now able to instantly send and receive money as they engage in their agricultural activities because of mobile money services. These services have penetrated rural areas, where 40% now have active financial accounts. Nearly one-half (46%) of Ugandans have financial services accounts, with mobile money leading the way to financial inclusion, as more than four in ten adults (43%) have mobile money accounts.

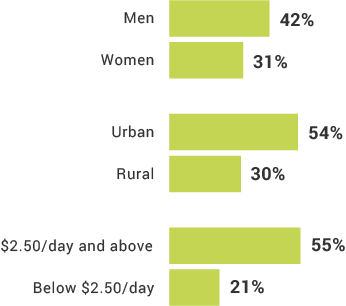

Seventy-three percent of Uganda’s adults live in rural areas and nearly six in ten adults (57%) are poor. Expanding access to mobile money services is helping to facilitate much-needed financial security, enabling individuals to pursue educational opportunities and maintain their livelihoods without relying on friends or family.

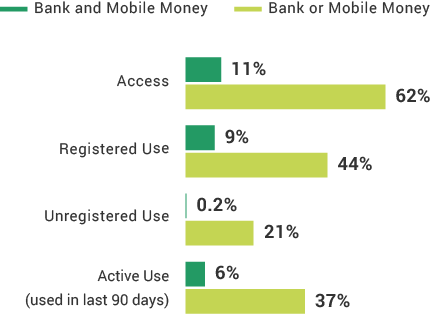

Financial Inclusion

Mobile Money

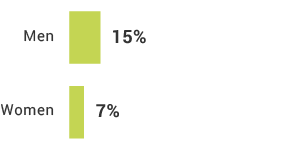

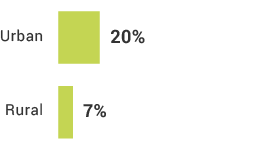

Bank Account Use (Holders)

What is the most common means Ugandans use to save money?

True or false

45% of Ugandans are digitally included.

True or false

Banks are the second most used financial service in Uganda.

Which demographic group is least likely to own a bank account?

Which demographic group is most likely to own a mobile money account?

True or false

Awareness of mobile money did not increase between 2016 and 2017.