Basic numeracy is the foundation for financial literacy and, with it, the road to financial inclusion. Financial Inclusion Insights (FII) measures and tracks basic financial literacy in all countries, assessing the degree to which the population is numerate, as well as the connectivity between numeracy, literacy, and desirable financial mechanisms. Measuring basic numeracy captures the ability to complete basic mathematical functions including addition, division, and savings and loan interest. Answering all of the questions correctly places the respondent in the high range, answering half or more correctly comprises the middle range, and less than half equals the low range.

The financial literacy indicator uses a combination of survey items that measure basic knowledge of four fundamental concepts in financial decision-making (interest rates, interest compounding, inflation, and risk diversification) following the Standard and Poor's Rating Service's Global Financial Literacy Survey methodology.

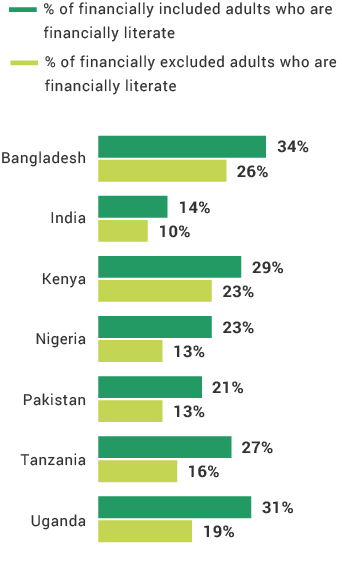

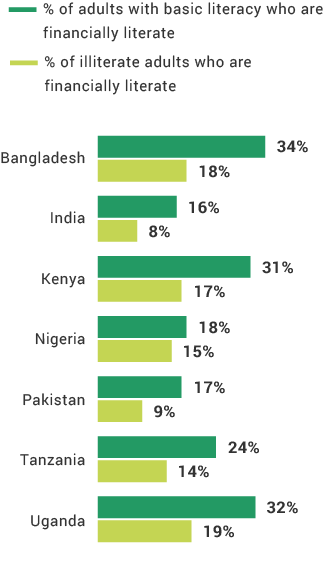

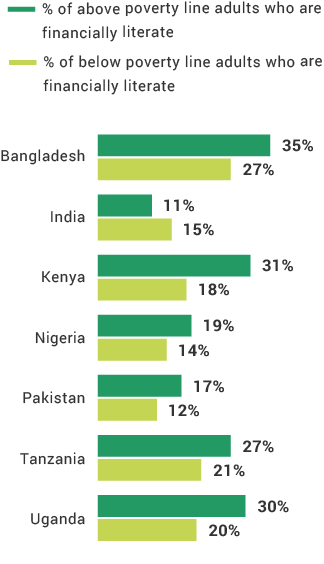

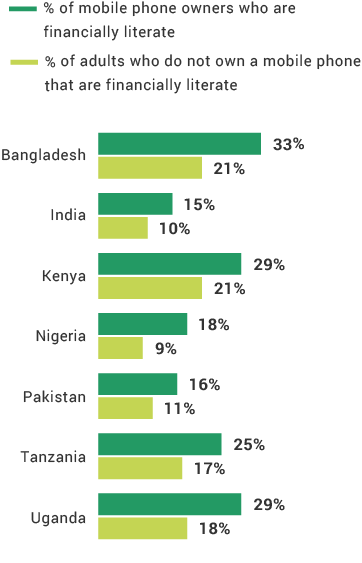

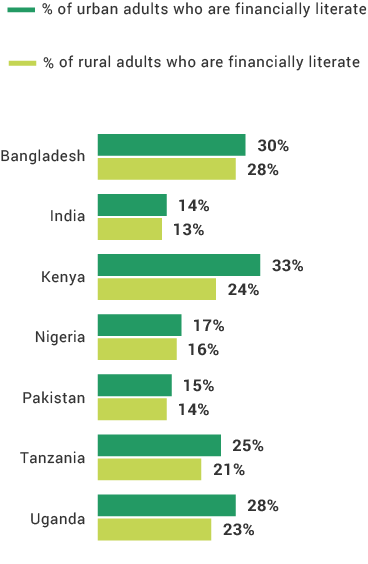

There are differences in financial literacy levels across FII countries. In 2017, 29% of Bangladesh adults are financially literate, compared with 13% in India. Demographic breakdowns in most of the countries follow the same patterns as financial inclusion overall—with female, rural, and below-poverty-line groups having lower literacy abilities than their counterparts except in India where those below poverty shows a slightly higher financial literacy capability than their counterparts. Education and technology are the two major avenues to increasing the ability to navigate the way to financial inclusion.

Financial Literacy

True or false

Among FII Southeast Asian countries, India has the lowest financial literacy.