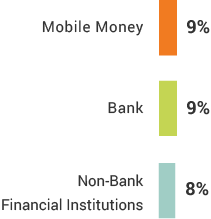

The Beninese financial market is broad and diverse; however, the formal aspect of this market has largely remained unused by most of the population. A quarter of Beninese adults have used formal financial services, but only a fifth report owning a registered formal financial account in their name. Conditions do exist for increasing financial inclusion, though. Many Beninese adults are financially active, with 47 percent report having saved in some manner and 20 percent reporting have borrowed. Mobile money awareness is high, as is access to mobile phones. An increase in the development of use-cases could spur adoption.

Photo © World Bank (licensed can be viewed here)

Financial Inclusion

Which mobile network operator has the greatest market share in Benin?

What is the most frequently cited reason for taking a loan in Benin?

True or false

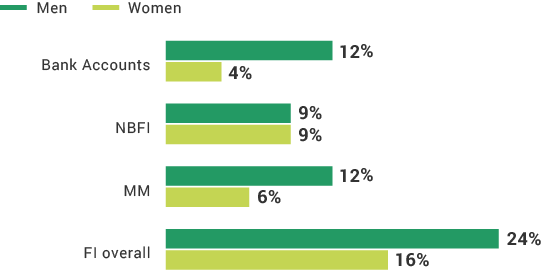

Men and women are financially included at the same rate in Benin

True or false

Benin has the lowest rate of phone access across all FII/MM4P countries?

True or false

The most frequently cited financial goal in Benin is “growing your businesses or a family member’s business”

True or false

Most Beninese who have used mobile money have a registered mobile money account.