As part of its Vision 2020 plan, the Rwandan government has set an ambitious goal to double the percent of adults who are financially included by 2017, and to increase that number by another 10% to 90% by 2020. Access to financial services in Rwanda is currently driven by two major types of services–Savings and Credit Co-operatives (SACCOs) and mobile phone-based financial services known as mobile money.

Mobile money services were first introduced in the country in 2010 and their use has grown tremendously, with one in four Rwandans using the services. As of late 2015, there were three major mobile money players–Tigo, MTN and Airtel. These, as well as SACCOs and banks, are all regulated by the Central Bank of Rwanda (BNR), per the 2010 Payments Systems Law. The government sees access to these financial services tools as a springboard to greater financial inclusion for Rwandans.

POLICY AND REGULATORY ENVIRONMENT

The Rwandan government has ambitious plans to become a middle-income country by 2020, and sees the development of the financial sector as key to meeting their targets.

Rwanda’s Vision 2020 outlines an ambitious development plan, which aims to transform the country into a knowledge-based, middle-income country, and a tech and financial hub for the region. A strategy to develop an inclusive and interoperable payments system is seen as core to meeting financial inclusion targets and supporting higher levels of economic activity. The Central Bank of Rwanda (BNR) is pushing the industry to learn and grow through experimentation, even encouraging failure as part of the learning cycle.

Impressive development is seen in other sectors too. For example, close to 90% of the population has health insurance, under Mutuelles de Sante, a government social health insurance scheme. The insurance is offered free to some of the poorest Rwandans and at low prices for others. The Rwanda Social Security Board (RSSB), in conjunction with the Ministry of Finance, is looking for ways to digitize the premium collections and offer its constituents the option of paying with mobile money.

The BNR released the Payments Systems Law in 2010, giving them the authority to oversee both bank and nonbank financial institutions that offer payments systems. There is also a comprehensive portfolio of regulations and guidelines that lays the foundation for effective governance of the entire payments sector. This has created a level playing field for both banks and nonbanks. However, there are some gaps in the regulatory environment that the central bank plans to address. Most importantly, the BNR still needs to introduce specific rules for nonbank e-money issuers (as opposed to payment service providers), and provide direction on issues such as fund safeguarding and isolation.

FINANCIAL SECTOR IN RWANDA

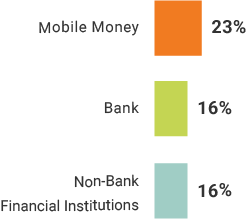

Rwanda’s financial sector consists of nine commercial banks, four microfinance banks, 491 MFIs (including both SACCOs and other MFIs), and two switches. Most of the country’s commercial banks focus on the affluent and middle-class population.

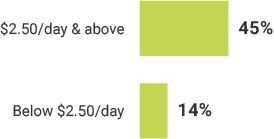

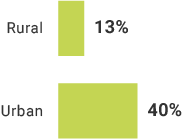

Nearly all financial institutions operating in Rwanda have a deposit-taking license and come under the supervision of the BNR. Formal access to savings is more common than access to credit. There are five times more deposit accounts than there are borrowers, and other studies suggest that few adults have access to credit from a bank. The majority of commercial banks have not managed to penetrate rural areas, and commercial and microfinance bank branches are mostly located in and around Kigali.

The introduction of the government’s SACCO program has driven much of the increase in financial inclusion.

The Umurenge SACCO (U-SACCO) initiative, introduced by the government in 2009 to increase financial inclusion in the country, has had notable success. The initiative has brought 1.6 million new customers into the financial sector through the establishment of district-level SACCOs (one for every district in Rwanda). The government notes that because of this initiative, 90 percent of Rwandans are now within 5 kilometers of a financial access point.

DIGITAL FINANCIAL SERVICES SECTOR IN RWANDA

Three mobile operators offer mobile money services in Rwanda—Tigo, Airtel and MTN. Banks are still figuring out their strategy in this space.

Mobile money was first introduced into the market in 2010 by MTN. Tigo and Airtel introduced their own mobile money products not long after MTN, in 2011 and 2013 respectively. Meanwhile, Bank of Kigali (BK) and Opportunity Urwego (UoB) partnered with mVisa to introduce mobile banking products in 2013. Some banks like Equity, Banque Populaire du Rwanda (BPR) and BK have invested in building their own USSD-based mobile banking services. They are also working to grow their own agent networks, with plans to extend their footprint into rural areas.

Banks and mobile money providers have made efforts to form bilateral agreements to facilitate account to account (A2A) transfers as well as ATM withdrawals. To drive customer adoption and usage, providers have been introducing beyond-payment products and services.

For example, Tigo, in conjunction with Urwego Opportunity Bank, launched an interest-bearing savings account on their mobile wallet which offers 7% interest to savers. Airtel introduced a credit product which provided customers loans with a biweekly term for repayment and a 10% facilitation fee. MTN has launched both insurance and school fees payments, and was also first to introduce P2G collection services in collaboration with the government.

Photo © A'Melody Lee / World Bank (license can be viewed here)

Financial Inclusion

Active Mobile Money Account Holders

True or false

Bill payment is a common advanced use case among active mobile money users in Rwanda.

True or false

30% of Rwandans access their formal financial accounts digitally.

True or false

Nearly 90% of Rwandans have the identification necessary to open a formal financial account.