In 2008 the country’s central bank–the Bank of Ghana (BoG)–issued branchless banking regulations that enabled banks to leverage digital technologies in the financial inclusion space, but limited the role played by mobile network operators (MNOs). By signing on to the Maya Declaration in 2012 and joining the Better Than Cash Alliance (BTCA) in 2014, the Government of Ghana has made a strong commitment to enabling digital financial inclusion. To help manage the growing digital financial services (DFS) sector in Ghana—which grew from an estimated 150,000 active users in 2011 to more than 4 million in 2015—the BoG released new guidelines governing e-money issuers and the use of agents in financial services in July 2015. These guidelines have been widely hailed as best practice.

As of late 2015, there were six main DFS providers in the country: MTN, Tigo, Airtel, Vodafone, Fidelity Bank and e-Zwich. MTN, Tigo, Airtel and Vodafone are all MNOs offering mobile money services throughout the country. In addition to these DFS-centric financial service providers, there are more than 27 commercial banks, 60 nonbank financial institutions (NBFIs), 138 rural and community banks, 503 licensed MFIs and hundreds of licensed individual susu collectors in the country.

Photo © Dominic Chavez/World Bank (license can be viewed here)

Financial Inclusion

Mobile Money Awareness and Use

True or false

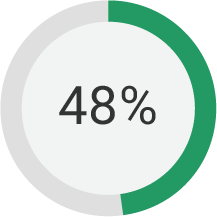

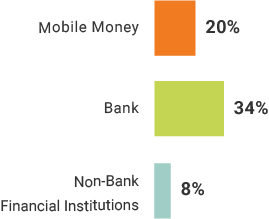

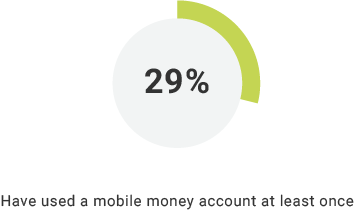

99% of Ghanaians are aware of at least one mobile money provider’s service, and 29% of them have use mobile at least once.

True or false

Youth are least likely to be active mobile money users.

True or false

The poor are just as likely to have an active bank account as they are to have an active mobile money account.

What percentage of the Ghanaian population has a mobile phone?

True or false

The rate of financial inclusion has grown faster in rural areas.

True or false

Financial exclusion in Ghana has fallen drastically over the past 5 years.