FII Research Approach and Methods

The FII practical research approach has two primary goals:

- Conduct robust measurement of key demand-side market indicators and more general market trends that can be broken down by key demographic, geographic and behavioral criteria, comparable across different countries; and

- Provide a breadth of user-focused insights to identify the barriers and facilitators of sustained adoption of digital financial services (DFS) in countries at varying stages of maturity.

A number of factors inform the particular research strategy and the design of the research instruments for each country:

- Country action strategies of the Financial Services for the Poor program at the Bill & Melinda Gates Foundation and consultations with the program’s staff

- Consultations with a broad range of financial inclusion stakeholders in the country

- Regulatory context

- Level of market development

- Population size

- Emerging and dominant transaction channels

- Range of active digital financial deployments

- Identification of focal areas to provide deeper insights to drive growth (e.g., leveraging Esusu savings groups in Nigeria, or digitization of worker salaries in Bangladesh).

Quantitative Survey Research

The FII Market Tracker Surveys

Nationally representative surveys provide measurement of access and use patterns in DFS as well as basic insight into why these patterns exist and what might influence their future evolution.

Sample sizes are based on the most recent and available population estimates for adults aged 15 or older and are set at levels which will allow statistically significant analysis of notable population segments (such as by region, gender, age groups, poverty level, and digital financial consumer type). Data quality control ensures accurate measurement so that FSP and other stakeholders base their decisions on sound evidence.

A significant benefit of national surveys is the range and depth of possible data analysis, particularly as the surveys are repeated over time and provide trend data. As a precedent, in the separate Tanzania Mobile Money Tracker project, InterMedia tracked the evolution of DFS usage patterns among various demographic and geographical groupings over time. This gave mobile operators in Tanzania a granular view on triggers and barriers to use.

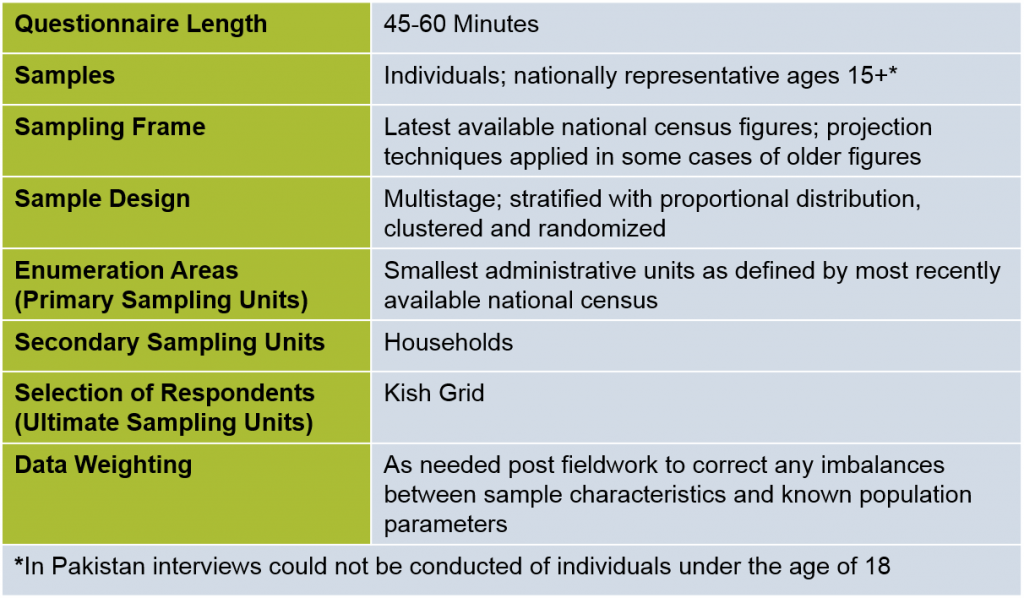

Summary of Survey Sampling and Methodology Principles

Qualitative Survey Research

Qualitative research adds value to quantitative data by going beyond the what to better explain the hows and whys. This leads to better information about how to – that is, how to guide DFS development in a positive, sustainable direction.

“Putting clients at the center” is a predominant theme in the development of DFS and many other services intended to help the poor. Qualitative research facilitates a client-centered approach by providing a voice for intended beneficiaries. Typically, the less formal and less structured qualitative research environment frees the participant and the moderator from a rigid Q&A survey format, prompting unanticipated insights as the conversation flows. This is particularly valuable in the formative stages of planning interventions and in environments where conditions (i.e. product mixes, regulations, demand trends) are changing rapidly.

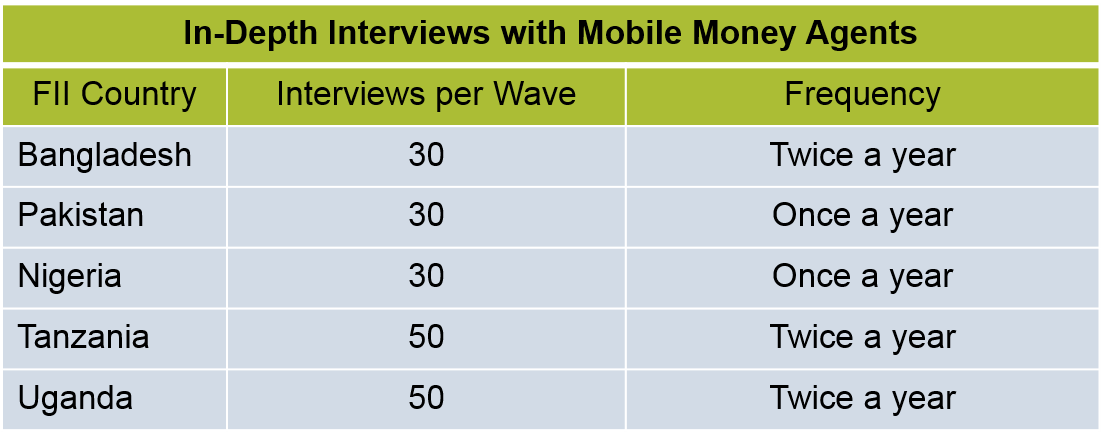

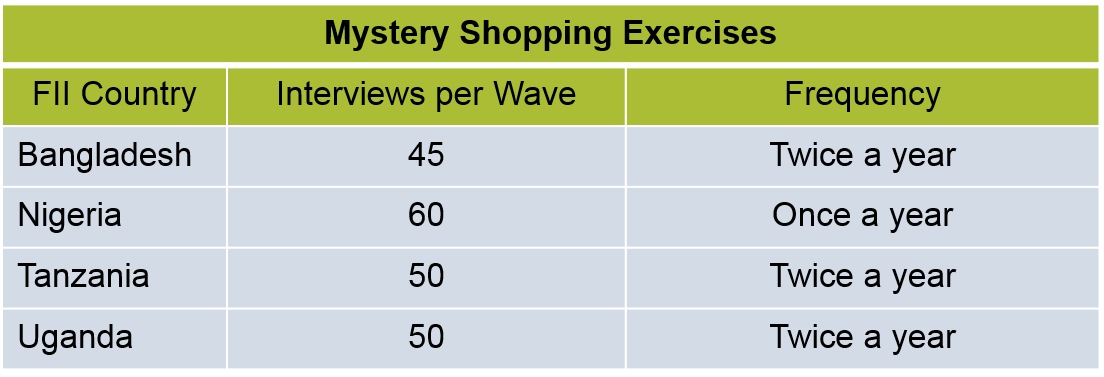

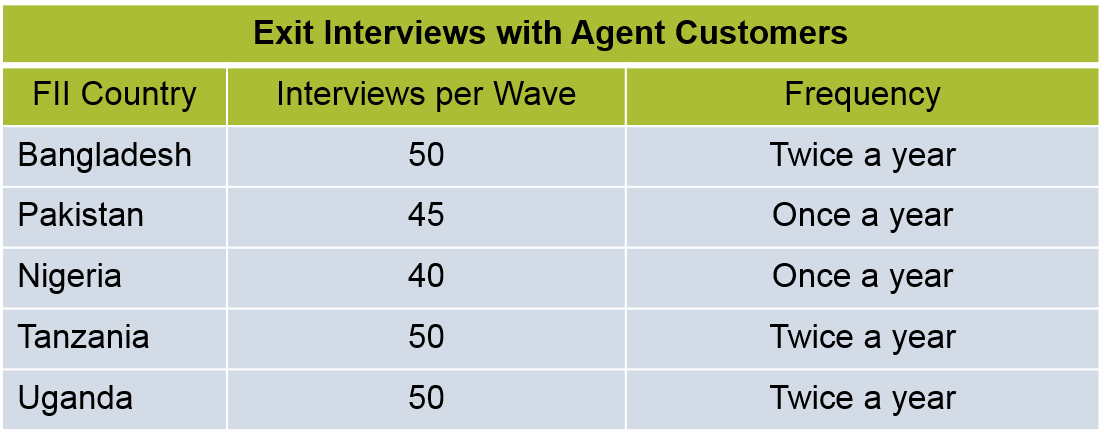

Understanding the Consumer Experience with Mobile Money Agents

In most countries, we are conducting a combination of mobile money agent interviews, “mystery shopping” exercises (in which researchers pose as mobile money users or potential users, at agent outlets) and exit interviews with agents’ customers to triangulate the customer/user experience. The hypothesis for this battery of research is that if a customer’s needs are understood well and are met by agents and the DFS they offer, then there is a better chance for consumers’ use of digital financial services and products on a sustained basis. In particular, this research addresses the critical issue of converting registered users into active users, and preventing active users from becoming lapsed users.

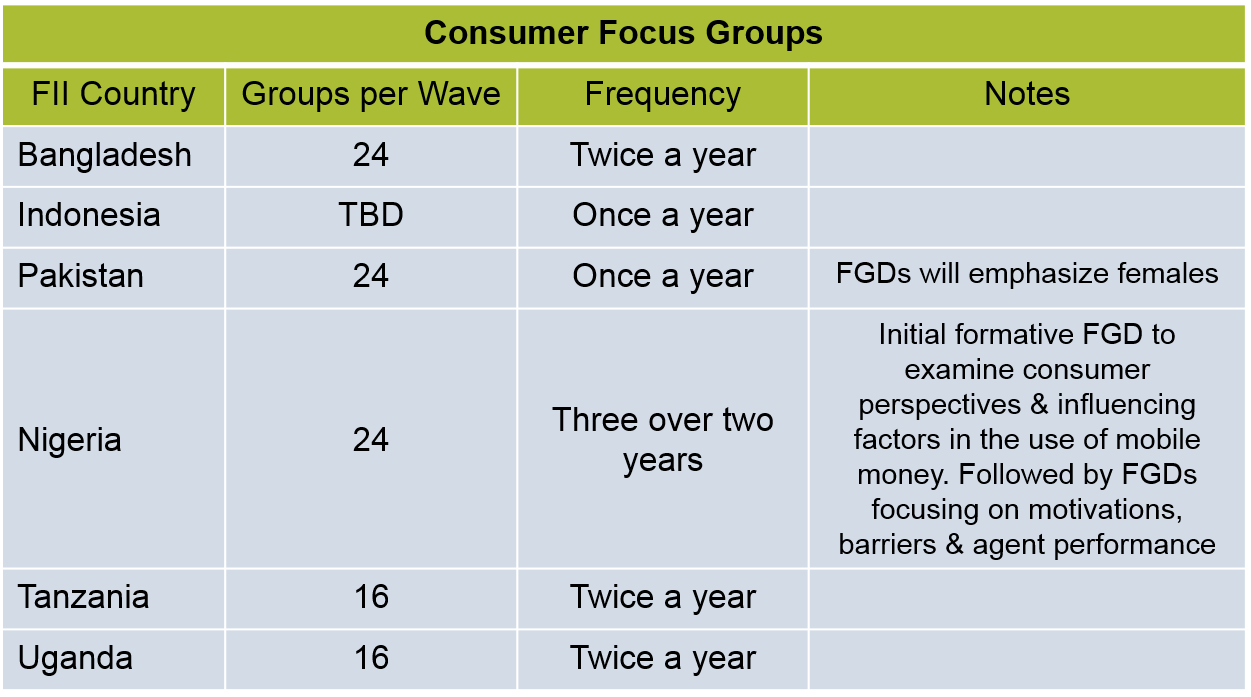

Understanding Consumers’ Financial Needs and Perceptions

Consumer focus groups allow FII researchers to obtain important insight on consumers’ financial habits, needs, perceptions and expectations in order to inform DFS development, marketing, commercialization and distribution networks. In particular, the consumer discussions differentiate between current users of DFS, non-users and those who did use DFS but no longer do so – lapsed users. This produces more customized insights for mobile operators, regulators and others to help guide their efforts.

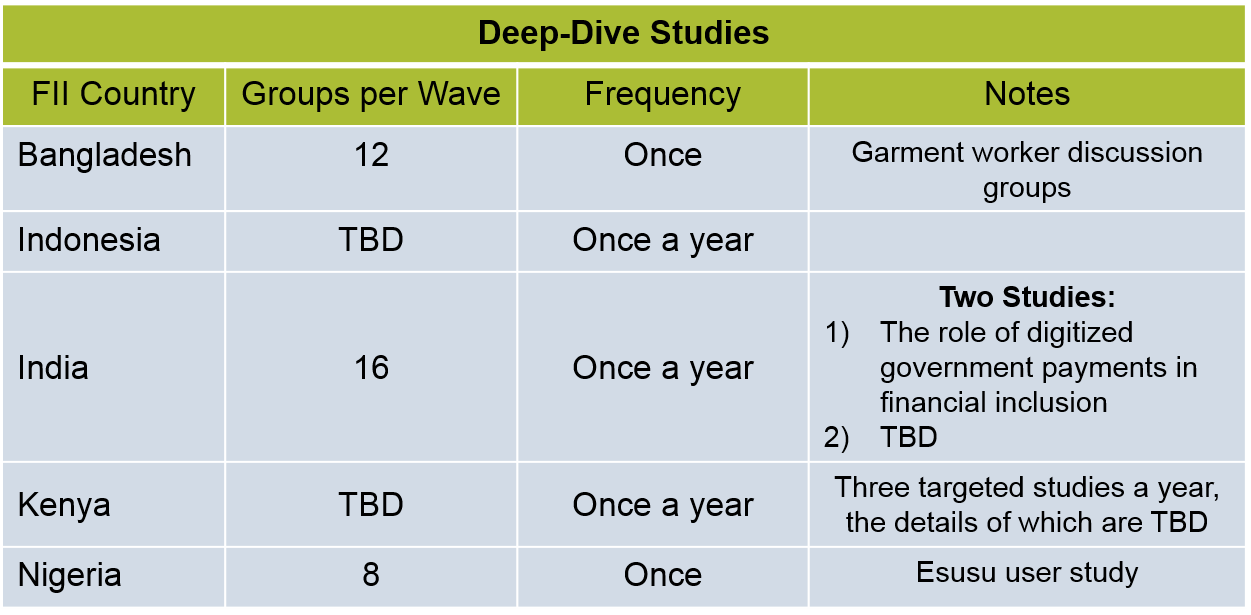

FII Deep-Dive Studies – Zeroing in on Key Issues by Country

These customized studies take various forms depending on the subject matter and goals