The FII Research Program

Overview

The FII program comprises quantitative surveys and related qualitative studies to explore the “what”, “how” and “why” of demand-side trends in mobile money and other digital financial services (DFS). All FII work is based on rigorous, consistent methodologies and data quality control procedures, reflecting best practices in social research and two decades of InterMedia experience gathering demand-side data in developing countries.

The FII Tracker Surveys

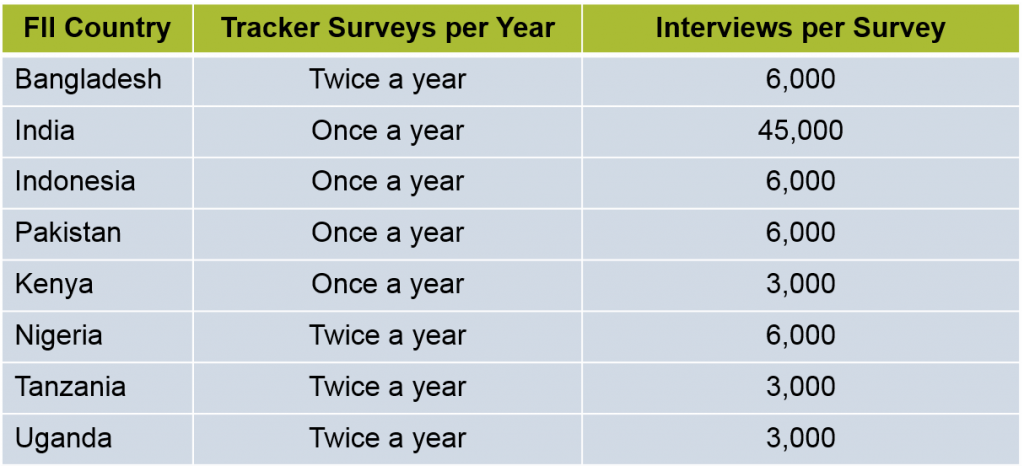

Tracker surveys began in fall 2013 and are conducted in each country either once or twice annually, depending on the country’s level of DFS development. These nationally representative surveys of individuals yield high-quality data tracking access and use trends, product/service awareness levels, and triggers and barriers to use.

All of the surveys include common core modules which incorporate a range of market measurement indicators, as well as detailed demographic information for market segmentation and other practical analysis.

Survey topics covered in all FII countries:

- Mobile Phone Access

- Bank Account Access and Use

- Mobile Money Access and Use

- Product Awareness

- Triggers/Barriers to Use

- Mobile Money Activities (Transfers, Payments, Savings, etc.)

- Mobile Money B2B Activities

- Consumer Experience with Mobile Money Agents

- Consumer Segmentation – Active/Lapsed/Non-Users

- Prevalence and Potential for Digital G2P and D2P Payments

Survey topics covered in selected FII countries:

- Assessing Consumer Need for Interoperability

- Digital/Prepaid Card Use

- Borrowing and Lending Habits

- Over-the-Counter (OTC) Mobile Money Use Trends

- Trust in Financial Instruments

- Financial Literacy

The FII Qualitative Studies

FII Consumer Experience Monitors

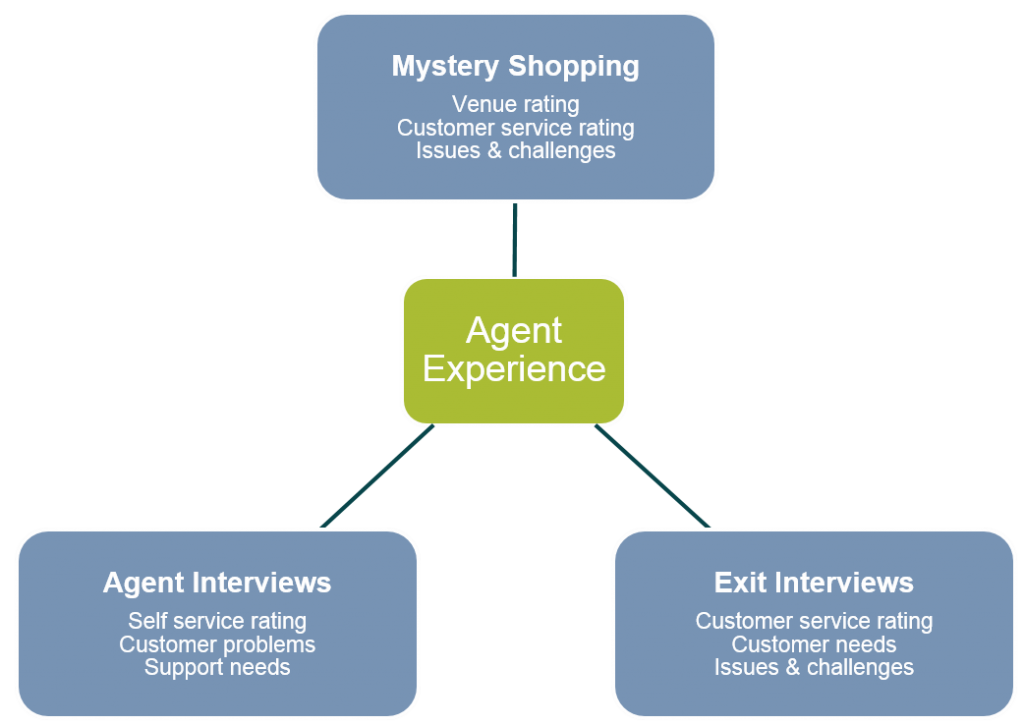

Understanding the agent experience – The FII research team produces 360-degree profiles of mobile money agent-customer dynamics through a combination of in-depth interviews with agents, exit interviews with agents’ customers and “mystery shopping” exercises, in which researchers pose as mobile money users or potential users, at agent outlets. This will provide valuable intelligence to network operators and regulators seeking to identify what works and what doesn’t at this critical point of service.

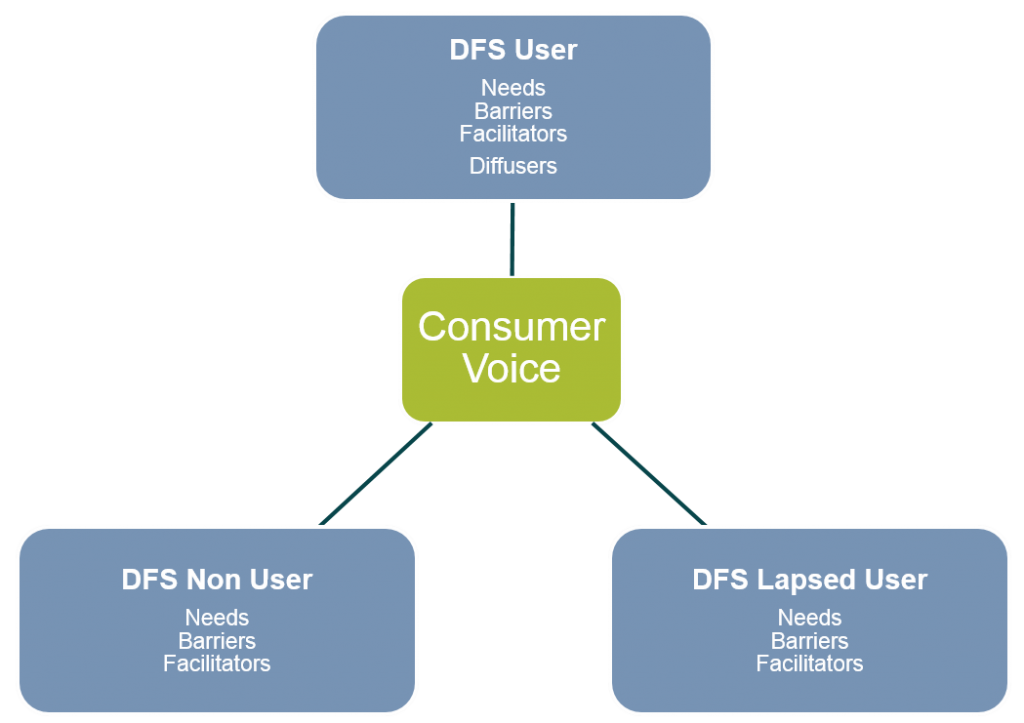

Consumer voices - Informed by key insights from the FII Tracker Surveys, FII researchers hold moderated discussion groups with consumers from key demographics – rural, poor, female, etc. – to gain deeper knowledge about their financial habits, needs and priorities, and, better understand their perceptions and experiences with mobile and digital financial services.

FII Deep-Dive Studies

The FII team “digs deep” on selected topics with customized research projects which differ from country to country. For example:

- Bangladesh – Digitizing payments in the garment sector – The FII team provided research support for a feasibility study on the conversion of salary payments to the country’s many garment workers to a mobile-based system. InterMedia conducted an innovative qualitative research project with garment sector workers to understand their cash management habits and how digitization of payments would fit with these habits.

- Nigeria –Leveraging Esusu savings groups on mobile/digital platforms – As in many countries, savers in Nigeria form groups (Esusus) to pool money that can be periodically distributed to a single member for major purchases or investments. The research project focuses on understanding Esusu dynamics and determining how mobile/digital financial tools can best complement this tradition.

- India – Digitizing government-to-person (G2P) payments – This study focused on the potential for leveraging the Aadhaar unique identification system to promote digitization of a variety of government benefit payments to citizens.