Bangladesh’s ready-made garment (RMG) industry is a primary source of foreign exchange revenue for the country, contributing over $30 billion from global exports and 10% of the country’s GDP in 2015. In addition, the RMG sector provides vital job opportunities to millions of migrant, low-income and semi-skilled workers in the country, employing over 4.5 million Bangladeshis. However, the same reasons that make Bangladesh’s RMG industry competitive at the global level also make its workers socially and economically vulnerable. Garment factory workers in Bangladesh are notorious for working in poor labor conditions, often with little accountability of total hours worked or wages received, and with little or no long-term financial or medical benefits provided to them through the factories. The 2013 Rana Plaza factory building collapse acted as a dire wake-up call for the international development community to improve the labor conditions in many of these factories, and some progress has been made. However, the workers’ economic conditions remain grim. At the moment, a large majority of these factories pay workers in cash, often having them queue up on payday and face the security risk of transacting in cash. The fact 80% them are women, many of whom lack financial literacy and access to formal financial services, further aggravates the situation.

The digitization of garment factory worker wages will alleviate this situation on multiple fronts, both from the management and worker perspective. For managers, wage digitization increases efficiency and cost-saving in the long term, while reducing the security risk involved in handling large sums of cash. For the workers, it increases transparency and accountability in the factories by requiring businesses to keep track of employee hours worked and wages paid, alongside reducing social and economic vulnerability by providing female factory workers with formal financial access. In fact, by removing some of the accessibility barriers female workers might face, such as inadequate physical access to ATM machines or insufficient private monetary income to open personal accounts, wage digitization offers an accelerated approach to financial inclusion. And, an accelerated approach is necessary: a recent study focused on RMG workers indicates that only 5% of the workers have access to any form of financial services and, in most cases, the services are provided by private cooperatives (in many instances with questionable legal status). In light of this, the Bill & Melinda Gates Foundation is currently working with Business for Social Responsibility to digitize wages in a few factories in Bangladesh through their HERfinance program, as a means to bring large numbers of unbanked people into the formal financial system.

From a financial inclusion perspective, there is further evidence to support large-scale wage digitization:

1.Building a digital payment “use-case”

According to the most recent Financial Inclusion Insights data, only 38% of Bangladeshi women are considered financially included. As developing “use cases” that suit the needs of specific populations is often the fastest means to increase uptake of financial services, receiving wages digitally instead of in cash might be the first step into the formal financial services sphere for many of these women. Not only does receiving wages digitally increase assess to digital financial services for these workers by providing them with personal financial accounts, the HERfinance program also provides vital financial education training that empowers them to make informed financial decisions. In the long term, this will improve the financial capability levels amongst female garment factory workers. It is also likely to improve the economic outlook of their families, since women are much more likely to invest in their families’ health, nutrition and education.

2.Salaried workers in Bangladesh are ready to be financially included

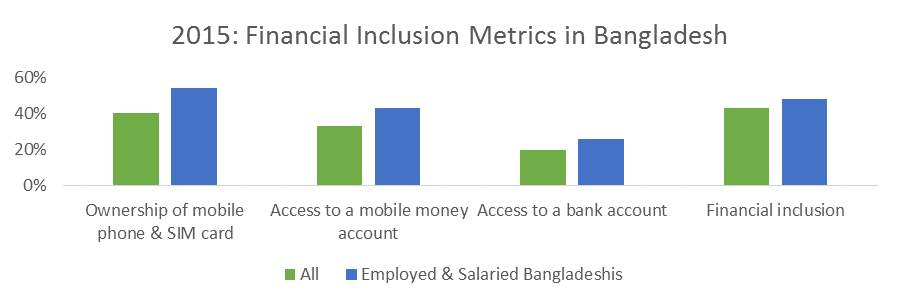

Based on 2015 FII data, 23% of Bangladeshis identified as being gainfully employed and receiving a salary on a regular or irregular basis. Though this analysis extends beyond just garment factory workers, it provides an important frame of analysis to consider that of the 23% of Bangladeshi workers, only 48% are financially included - even though 83% have access to a mobile phone and SIM card. Additionally, of the employed and salaried workers, currently less than 3% received wages in their bank accounts and an even smaller proportion report receiving wages in a mobile account.

Overall, however, the salaried and employed working population is well positioned to be financially included. With higher mobile phone ownership and access to mobile money accounts, they are much more financially engaged than the average Bangladeshi.

*Percentages based on InterMedia’s Financial Inclusion Insights 2015 Bangladesh survey data

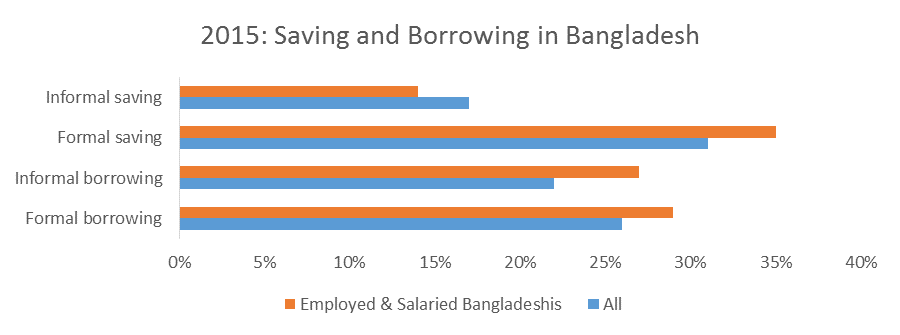

Salaried workers also rely more heavily on formal financial services to meet their financial needs than the average Bangladeshi, which indicates they are more likely to be active financial users once financially included.

*Percentages based on InterMedia’s Financial Inclusion Insights 2015 Bangladesh survey data

3.Developing a financial ecosystem for further financial service adoption

To successfully transition garment factory workers from cash to digital wages, as well as to encourage continued use of digital financial services, most important is to take an ecosystem approach to building an inclusive digital payments network. At the moment, most workers are likely to be hesitant, perhaps even resistant, to receiving wages digitally in an environment where all their payments need to be made in cash. This is because in the current cash-led ecosystem, instead of easing delivery of financial payments, digital wages actually add an additional step for Bangladesh’s wage workers, in that they now have to cash out their wages before making their grocery, rent or school fee payments.

Remedying this situation would require a deeper understanding of the payment streams (in addition to wages) that need to be digitized, to develop an open and inclusive digital payments ecosystem. Further, any robust and effective digital payments network would also require an enabling regulatory framework that promotes transparency and accessibility, and proactively engages all stakeholders. In particular, existing financial system players and components, such as formal bank accounts, microfinance institutions, credit bureaus, card payment platforms, ATMs, agents, merchants, and payment networks must be able to function in a cohesive manner.[1]

Finally, the building of a digital payments ecosystem is vital not only to encourage use of digital financial services, but also to cultivate the accompanying effects of wage digitization on the “social” financial ecosystem of the workers. Those in the garment factory workers’ social network, such as household members, community members or neighborhood businesses, are likely to benefit from having increased interactions with digital financial services through the garment factories. This is especially likely given that garment factory workers usually live and transact in fairly small social ecosystems, where digitizing one payment stream could have numerous far-reaching effects on adoption of financial services.