Gains in financial inclusion in 2018 were driven by a 5 percentage-point increase in bank account holders

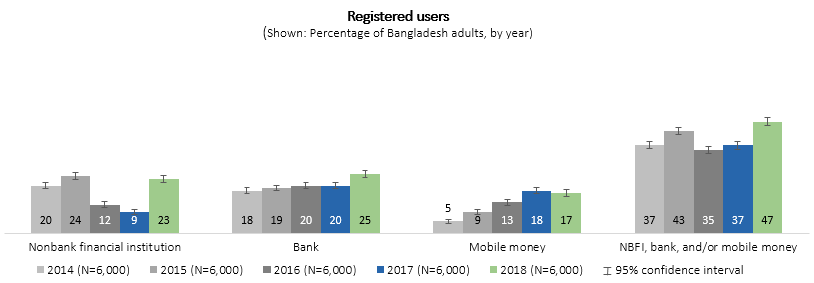

In 2018, nearly half of Bangladesh adults (47%) were financially included via a bank, mobile money, or nonbank financial institution (NBFI) account, according to the InterMedia’s latest Financial Inclusion Insights (FII) survey. From 2017 to 2018, the successful rollout of agent banking and surge in bank account ownership across the population, including among the rural poor and women, spurred the increase in financial inclusion. Since the first FII survey was conducted in 2013, 27% more of the adult population (aged 15+) has become financially included, driven by the increasing uptake of bank and mobile money accounts.

Compared to other Asian markets where banks tend to dominate, Bangladesh hosts a greater diversity of formal financial institutions that cater to different segments of the market. There is an almost equal uptake of banks, mobile money and NBFIs, especially microfinance institutions. Since 2014, mobile money users have seen the greatest growth (from 5% to 17%), followed by bank users (from 18% to 25%). NBFIs have maintained a steady share in the market, varying between 20-24% of the population.

Efforts to expand the supply of banking services for the rural poor are bearing fruit, as the central bank and commercial banks have made concerted efforts to promote and expand agent-banking services for the last three years. Through the agent-banking model, banking services are provided outside of regular bank branches by engaged agents under a valid agency agreement. As a result, bank account ownership increased among the overall population (20% to 25%) and among the rural poor (13% to 18%) between 2016 and 2018.

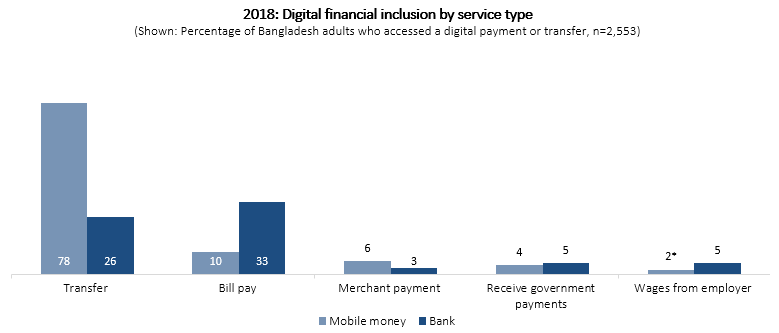

In 2018, over 4 in 10 adults (43%) had ever used a digital payment or transfer. Conducting person-to-person (P2P) mobile money transfers was the most common use case, taken up by 78% of digital financial services (DFS) users. P2P mobile money transfers, from both individually registered accounts and over-the-counter transfers from agent accounts, were used by three times as many adults as those who used bank transfers. Bill payment was the most popular digital use case for banks; 33% of DFS users used a bank for bill pay. Users of government-to-person (G2P) payments are also growing, as the Bangladesh government has been making significant efforts at G2P digitization. In 2018, an almost equal proportion of adults who engaged in digital transactions received government payments through bank (5%) or mobile money (4%) accounts.

The large majority of the population, in 2018, possessed the key resources that enable DFS adoption – necessary ID (86%), mobile phones (84%) and SIM cards (79%). Lack of these key resources is therefore not a major constraint on the growth of financial inclusion. The key skills needed to use a digital account were relatively rare; only 24% of adults reported having at least “a little ability” to use their phone to perform a financial transaction. Less than half of adults (47%) had the ability to text, and less than one-third (28%) were financially literate (possessing the basic knowledge of key concepts for financial decision making). The lack of these skills is a constraint on the uptake of registered financial accounts for unassisted DFS use. The majority of the population is, therefore, likely to rely on agents to facilitate financial transactions, even as DFS uptake increases.

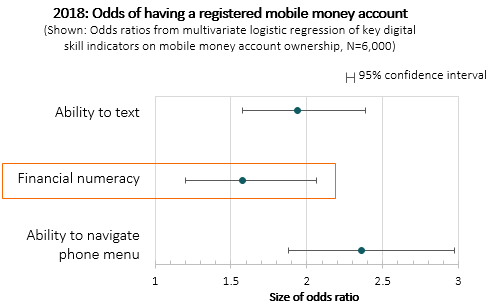

For the first time, the FII 2018 Bangladesh survey measured financial numeracy as a key skill for DFS adoption – 8 in 10 adults (83%) were financially numerate. Financial numeracy measures skills needed to complete a financial transaction on a mobile phone without assistance. In the survey, adults were counted as financially numerate if they could add 200 to 2000 (Taka), and avoid a place value error when reading the number 1,080 (Taka). Those who lack financial numeracy are more prone to accidentally sending the wrong amount of mobile money by an order of magnitude when using an account on their own phone. Most Bangladesh adults were financially numerate, suggesting that this skill is not a major constraint to greater account ownership and unassisted DFS use.

Analysis of key digital skill indicators predicting mobile money account ownership showed that financial numeracy, ability to text, and ability to navigate a phone menu increase the likelihood of having a registered mobile money account. Financially numerate adults in Bangladesh were 50% more likely to have a registered mobile money account than those who were not financially numerate. However, ability to navigate a phone menu and text were stronger predictors of the likelihood of having a mobile money account than financial numeracy.

While data showed a gender gap of 8 percentage points in overall financial inclusion, the gender gap in digital financial inclusion was larger, amounting to 15 percentage points. Considerable strides have been made in increasing account ownership among women in Bangladesh. From 2014 to 2018, the percentage of women who had an account in their name with any full-service formal financial institution increased from 35% to 43%. Additionally, the 5 percentage-point increase in registered bank users between 2017 and 2018 was almost equally shared between men and women, suggesting that expansion of agent banking is likely encouraging greater bank account ownership among women. In 2018, while fewer women than men had bank or mobile money accounts, a much higher proportion of women had NBFI accounts (27% of women versus 20% of men), indicating that NBFIs are serving the financial needs of women more so than that of men.

.png)

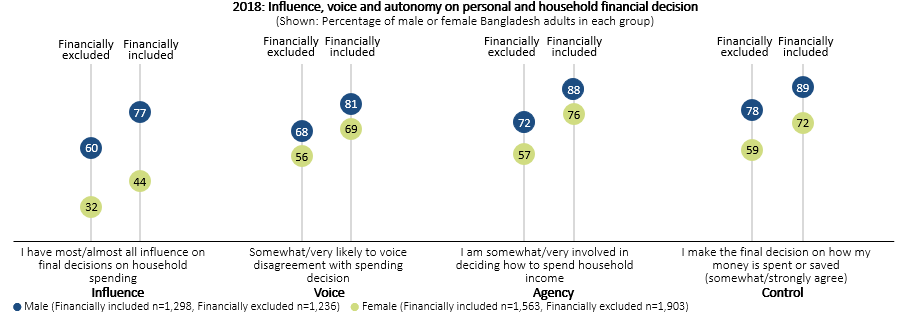

Account ownership contributes toward economic empowerment. The FII survey tracks economic empowerment through a set of four indicators that measure the influence, voice, agency and control adults have in their household financial activities. A greater proportion of financially included women reported having influence, voice, agency and control in their household than financially excluded women. Moreover, data showed that the gender gap on all four empowerment indicators was smaller for financially included adults compared to their excluded counterparts.

Strides in financial inclusion are evident. But, with over half of Bangladesh adults still financially excluded, there is a long way to go before financial inclusion expands to the entire population, especially to encompass more women, rural and poor segments. Current trends suggest that increasing bank account ownership through agent-banking services, and continued uptake of mobile money accounts and NBFI accounts will likely pave the way for greater financial inclusion among all segments of the adult population in the coming years.

Financial Inclusion Insights (www.finclusion.org) is an ongoing research program funded by the Bill & Melinda Gates Foundation and designed to build meaningful knowledge about how the financial landscape is changing across eight countries in Africa and Asia (Bangladesh, India, Indonesia, Kenya, Nigeria, Pakistan, Tanzania and Uganda).

Explore the new Data Fiinder on the Finclusion website and read about the Data Fiinder’s new updates and features on our blog post.

Contact us via email or follow us on Twitter for other updates from the InterMedia FII Team.