The FII 2017 data shows high levels of financial inclusion readiness, but a decline in bank account holders

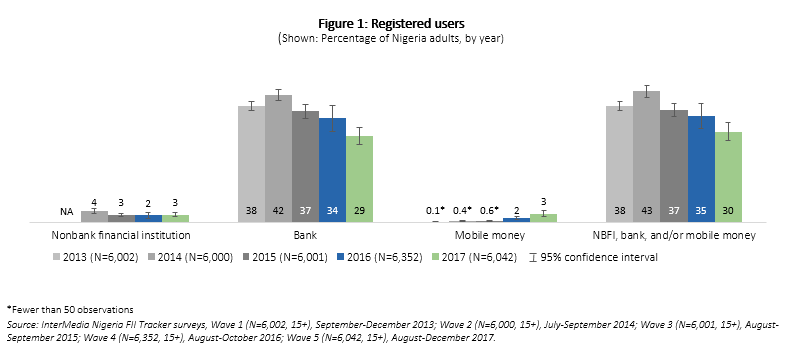

InterMedia’s Financial Inclusion Insights (FII) 2017 data shows that 30% of adults in Nigeria were registered users of a full-service financial institution (financially included). By this measure, financial inclusion is down 13-percentage points from the high point of 43% of adults reached in 2014 (Figure 1). What explains the downtrend?

Several factors are working against Nigeria’s bank-led model of financial inclusion. The leading cause is the overall weakness of the banks amid a slow recovery from a prolonged economic recession, sparked by low oil prices. Nigeria’s economy contracted for five consecutive quarters over 2016-2017, according the World Bank. The national currency, the Naira, has been devalued and inflation has been stubbornly high. To support the banks, interest paid to savers has been held below inflation, while borrowers must pay high rates of interest on loans. Loans are thus expensive, and money loses value when it stays in a bank account. In these circumstances, people appear to be turning away from banks for their financial needs.

An additional factor is the enforcement of the CBN’s requirement that each bank customer must link their account to a biometric Bank Verification Number (BVN), a major step forward for enforcement of Know Your Customer (KYC) rules. Holders of inactive or underused accounts may have allowed them to lapse rather than undertake the biometric registration process. Statistics from the Nigeria Inter-Bank Settlement System (NIBSS) show that Nigerian banks lost over 2 million customers between 2016 and 2017.

What are the implications of the drop in financial inclusion for the average Nigerian?

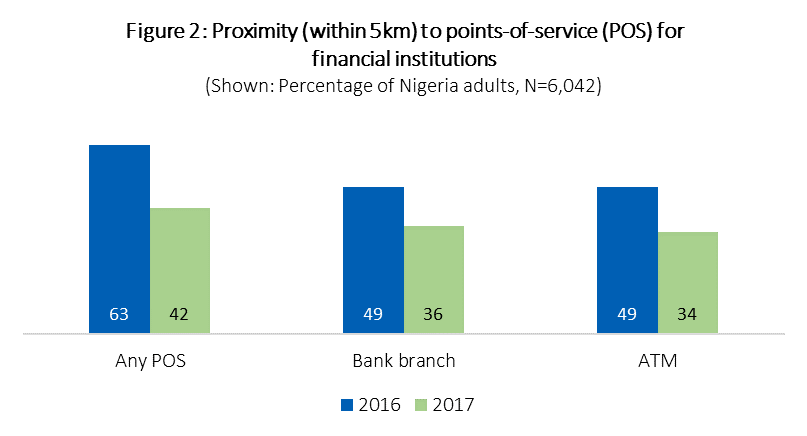

Proximity to financial points-of-service decreased. In 2017, only 42% of the population knew of a financial point-of-service (POS) within 5 kilometers of their household compared to 2016 numbers when two-thirds of the population (63%) knew of a POS within the same distance (Figure 2). Further, awareness of a financial point-of-service within one kilometer of home dropped from 48% of adults in 2016, to 31% in 2017. With the exception of bank branches and ATMs, the large majority of adults did not know of a POS for mobile money, informal groups, MFIs and SACCOs. The lack of awareness of a POS for these other financial institutions could partially explain the declining trend in financial inclusion.

Registered users of mobile money increased, but they remain only 3% of adults (about 3.3 million individuals). The decrease in registered bank users more than offset the increase in registered mobile money users, dragging down financial inclusion overall. While banks continue to dominate the financial landscape in Nigeria, bank account holders are becoming rarer, falling from a high of 42% of adults in 2014, to 29% by 2017. Registered users of both mobile money and NBFIs each accounted for only 3% of adults.

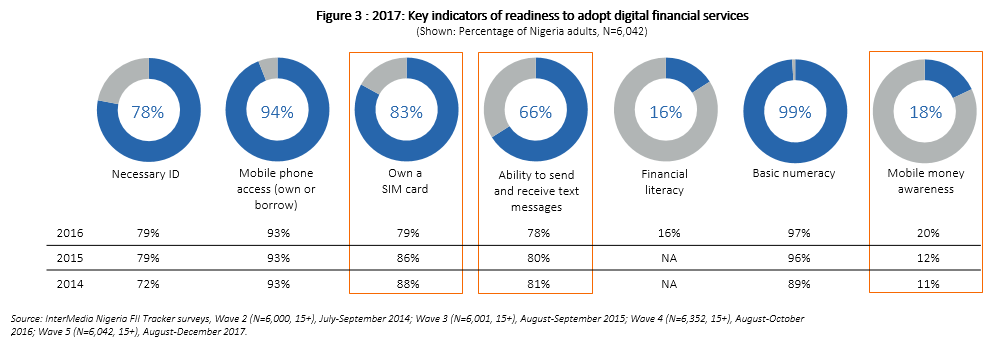

Adults in Nigeria satisfy many preconditions for adopting digital financial services, but the large majority of the population is not aware of mobile money. Nearly all adults have basic numeracy skills (99%), have access to a mobile phone (94%) and own a SIM card (83%) (Figure 3). Likewise, 78% of adults have the identification required to register a financial account and 66% have the ability to send messages – a good proxy for the phone skills needed to complete a transaction. However, other equally important measures of financial inclusion readiness are low: 16% of adults are financially literate and only 18% have mobile money awareness.

The way forward from here

The Nigerian government has announced a new flagship effort to improve financial inclusion in the country. The government enacted a new plan in March 2018, called the Shared Agent Network Expansion Facilities (SANEF), which licenses 500,000 banking and mobile money agents across the country. These agents will provide digital financial services and promote financial literacy. Likewise, CBN has also reconsidered the role of mobile network operators in its financial inclusion drive; a recent agreement between the Nigerian Communications Commission and CBN will allow Telcos to operate in the mobile money space. The FII team will continue to monitor these opportunities to assess whether improvements in the banking and agent networks as well as product innovation will promote growth in financial inclusion.

For more information regarding the FII team’s research in Nigeria, read the 2017 Nigeria Annual Report, or contact Charles Wanga, Research Manager, Financial Inclusion Insights. If you are interested in seeing additional information about the factors that affect financial inclusion in Nigeria, we encourage you to visit the Data Fiinder at finclusion.org.

Financial Inclusion Insights is an ongoing research program funded by the Bill & Melinda Gates Foundation and designed to build meaningful knowledge about how the financial landscape is changing across eight countries in Africa and Asia (Bangladesh, India, Indonesia, Kenya, Nigeria, Pakistan, Tanzania and Uganda).